Prayagraj, formerly known as Allahabad, is one of the oldest cities in India and is located in the state of Uttar Pradesh. Prayagraj Municipal Corporation or Prayagraj Nagar Nigam (PNN) is responsible for providing public facilities and implementing various infrastructure projects. It also collects housing taxes from property owners, which make up a significant portion of its revenue. Prayagraj Nagar Nigam housing tax can be paid online through the official portal of the authority.

Housing Tax Prayagraj: Overview

Prayagraj property tax is an annual tax that residential and non-residential owners have to pay to the Prayagraj Municipal Corporation. Prayagraj Municipal Corporation has an online portal for online property tax payments and other services. To avoid penalties, you must pay your property taxes on time. Property owners should be aware that there is no property tax refund or rebate policy.

How is housing tax calculated in Prayagraj?

- Property tax in Prayagraj is calculated based on several factors such as

- Total assets or asset area

- building area of the house

- carpet area

- number of floors

- Property type

- Property owners are required to obtain a self-assessment form from the district office or Prayagraj Municipal Corporation Campus to calculate property tax. You must provide the correct information such as property type, occupancy, and area to ensure accurate calculations and avoid penalties.

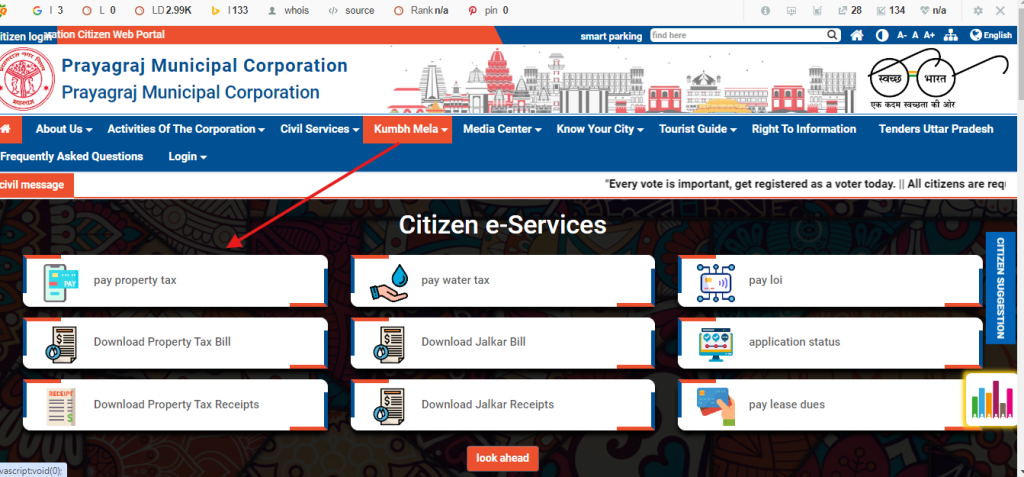

How to Pay Prayagraj Property Tax Online :

Visit the official website https://www.prayagrajsmartcity.org/

you can see the option “Tax Payments ” on the top right

You will get a page where you need to fill in all the details like Name, ward, zone, mohalla etc. And then click on the search option

Fill all the details and make a payment

Method 2:

you can also visit https://allahabadmc.gov.in/ website and click on the property tax option, you will get a page where you need to enter your property tax number (or) old property tax number and you will get tax details and make a payment

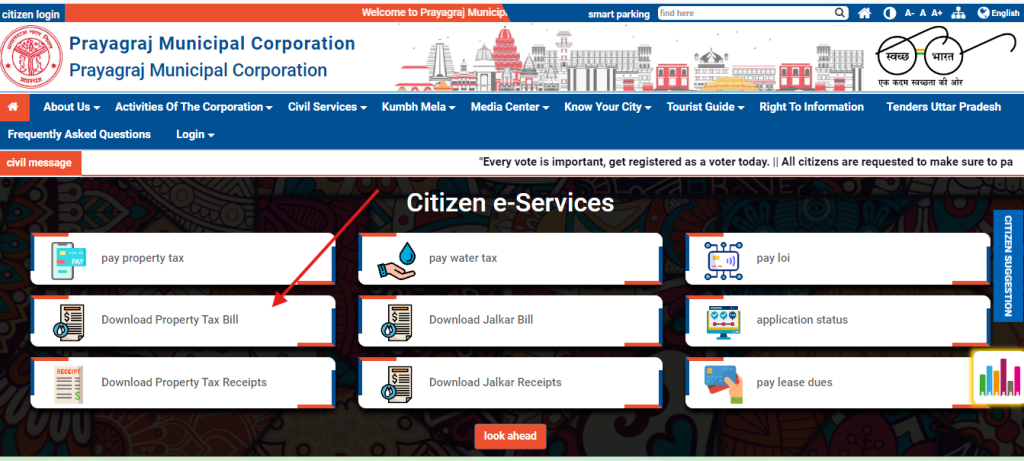

How to download the property tax bill

visit the website https://allahabadmc.gov.in and click on ‘Download property tax’ bill, enter your property number and select financial year, and click on Go ahead. you will get a property tax bill for that particular year.

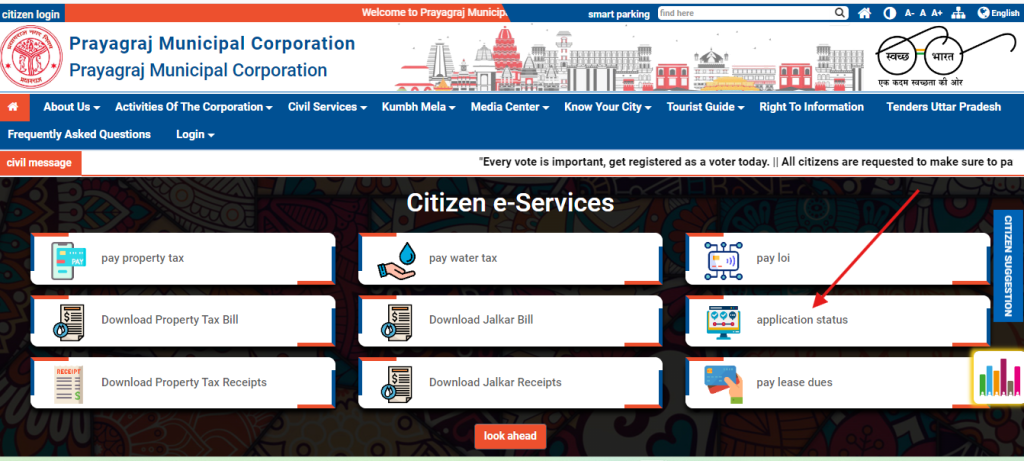

How to know the application status:

Visit the website https://allahabadmc.gov.in and click on application status

enter your application reference number and click on Go ahead, you will get the details of your application

Frequently Asked Questions:

Prayagraj property tax is an annual tax levied by the Prayagraj Municipal Corporation (PNN) on residential and non-residential properties. It’s a major source of revenue for the city’s infrastructure projects and public facilities.

There are two ways to pay your Prayagraj property tax online:

Method 1: Visit the official website (https://www.prayagrajsmartcity.org/) and go to “Tax Payments” section. Enter details like name, ward, zone, etc. to search for your property tax and make a payment.

Method 2: Visit the Prayagraj Municipal Corporation website (https://prayagraj.nic.in/public-utility/prayagraj-nagar-nigam/) and select the “Property Tax” option. Enter your property tax number (or old property tax number) to view your tax details and make a payment

Go to the Prayagraj Municipal Corporation website (https://prayagraj.nic.in/public-utility/prayagraj-nagar-nigam/) and click on “Download Property Tax Bill.” Enter your property number, select the financial year, and click “Go Ahead” to download your property tax bill for that year.

Suggested Articles:

SMC Property Tax: Pay Online, Calculate & Understand Your Tax

NMMC Property Tax 2024: How to Pay Navi Mumbai Property Tax

BMC Property Tax 2024: How to Pay Brihanmumbai Municipal Tax