Adilabad Municipality takes the hassle out of property tax payments. Whether you opt for online convenience or prefer the traditional offline method, managing your property taxes in Adilabad is now simpler than ever. Learn about the step-by-step processes, calculation methods, and benefits of timely payments below.

Adilabad Municipality Property Tax Calculation

Determining your property tax obligations in Adilabad is now a breeze. Thanks to the user-friendly tax calculator provided by the Commissioner and Director of Municipal Administration (CDMA), Telangana, you can easily assess your outstanding tax amount. The following details are essential for using the Adilabad Municipality Property Tax Calculator:

- A registered title deed, court decree, or patta.

- Building Permission Details

- District Information

- Urban Local Body (ULB)

- Locality or Grama Panchayat Name

- Street Name

- Total Plot Area (in Sq Yd)

- Zone

- Floor Number

- Sanctioned Plinth Area (in Sq mt)

- Sanctioned Building Usage

- Building Classification

- Constructed Building Usage

- Type of Occupants

- Construction Date

- Number of Sanctioned Floors

- Construction Value (in Sq ft)

- Length and Width of Construction (in Meters)

- Plinth Area (in Sq mt)

How to Pay Adilabad Municipality Property Tax Online

Experience the convenience of paying your property tax online through the official Adilabad Municipality website.

Visit the Official Adilabad Municipality Website: Navigate to the designated website.

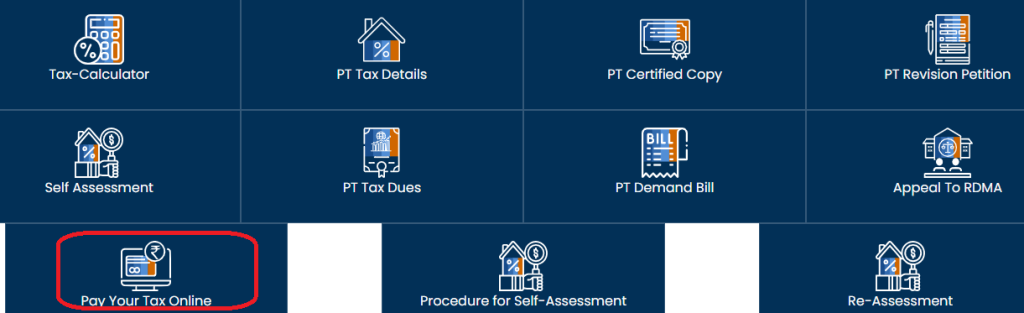

- Access Property Tax Services: Click on the ‘Property Tax (House Tax)’ link under the ‘Online Services’ menu.

- Redirect to CDMA Website: You will be directed to the CDMA website for online transactions.

- Initiate Payment: Click on the ‘Pay Your Tax Online’ link.

- Enter Property Details: Depending on your preference, input either your Property Tax Identification Number (PTIN) or door number.

- Retrieve Property Details: Provide the necessary information and retrieve your property details.

- Complete Payment: Follow the prompts to complete your payment securely.

Note: Ensure you have a valid PTIN or door number, internet connectivity, and bank details for online transactions.

Also Read: Nizampet Municipal Corporation: How to Pay Nizampet Property Tax

How to Pay Adilabad Municipality Property Tax Offline

Prefer the traditional approach? Visit the municipality office in person to fulfill your property tax obligations. Here’s a brief overview of the offline payment process:

- Visit Municipality Office: Head to the municipality office during working hours.

- Seek Assistance: Approach the officials for guidance on the payment procedure.

- Submit Documents: Ensure you have all necessary documents and submit them as per the instructions provided.

- Complete Payment: Make the payment following the guidelines outlined by the officials.

Important Dates and Penalties

- Last Payment Date: Typically, the deadline for Adilabad Municipality Property Tax payments falls on April 30th.

- Penalties for Late Payment: Failure to adhere to the payment deadline incurs penalties. However, timely payments attract a rebate of 5% on the tax amount.

Open Plots Near Hyderabad

Streamlined Property Tax Mutation Process

Initiating property mutation in Adilabad Municipality is now more accessible than ever. Follow these steps for a smooth mutation process:

- Visit Official Website: Access the Adilabad Municipality website.

- Navigate to Mutation Services: Click on ‘Mutations’ under the ‘Online Services’ menu.

- Access Mutation Form: Fill out the mutation form with accurate details after receiving the OTP.

- Submit Required Documents: Upload all necessary documents in the prescribed format.

- Payment and Approval: Complete the payment process once your application is verified and approved.

- Confirmation: Receive confirmation of successful mutation via SMS.

Documents Required for Mutation Process:

- Sale Deed

- Will Deed

- Court Deed

- Partition Deed

- Gift Deed

- Released Deed

- Legal Heir Document

- Revocation Deed

- Settlement Deed

- Rectification Deed

- Cancel Deed

Conclusion

Paying your property tax on time in Adilabad Municipality not only fulfills your civic responsibility but also contributes to the city’s development. Whether you opt for the online or offline method, timely payments ensure you enjoy attractive rebates and incentives while avoiding penalties. Simplify your property tax management today with Adilabad Municipality’s convenient payment solutions.

Frequently Asked Questions (FAQ’s)

Ans: Property tax in Adilabad Municipality is calculated based on various factors such as plot area, construction details, building usage, and occupancy type. The Commissioner and Director of Municipal Administration (CDMA), Telangana provides a tax calculator to assist taxpayers in determining their property tax obligations.

Ans: To pay property tax online in Adilabad Municipality, visit the official municipality website, navigate to the property tax section, enter your property details or PTIN, and complete the payment using your bank details.

Ans: 504001 is the Pincode of Adibatla.

Latest Blogs

- RBI Repo Rate & Reverse Repo Rate 2025: All you need to know

- Telangana Investments at the Davos Summit 2025: Latest update

- RRR Project New Update: ₹7,104 Crore Telangana’s Future in Infrastructure Development