The Bareilly Municipal Corporation, also known as Bareilly Nagar Nigam (BNN), is responsible for the effective management of property taxes within the city. Recognizing the need for an efficient process, BNN has recently launched a user-friendly portal designed to simplify the payment and calculation of house tax for its residents. With a system that rewards timely payments with attractive rebates and discounts, understanding how to navigate this new tool is essential for every property owner in Bareilly.

Calculating Your Property Tax in Bareilly

Property tax in Bareilly is a mandatory annual fee collected from property owners by the local municipal authority. It’s important to note that properties under central government ownership and vacant properties are not subject to this tax. The funds collected are crucial, contributing to public services such as education, infrastructure maintenance, and sanitation.

The tax amount depends on several factors, including property size, construction quality, location, and specific building characteristics. The tax is calculated using the following formula:

Annual value of the building = 12 × Minimum monthly rental rate (as determined by the chief municipal officer) × Carpet area of the building

The resultant annual value is then multiplied by the general tax rate and divided by 100 to determine the amount of tax due.

How to Pay Online Bareilly Nagar Nigam Tax:

Paying your house tax online is straightforward with the following steps:

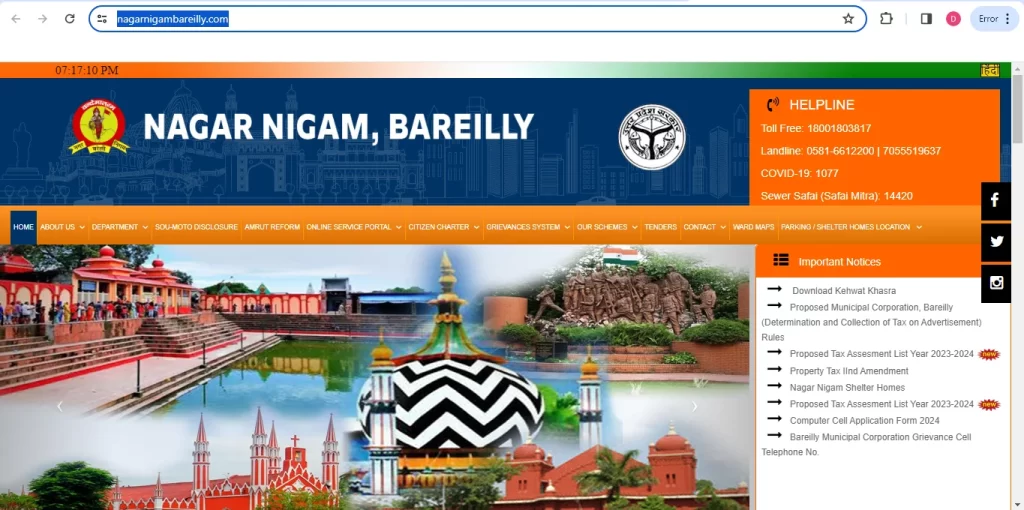

- Visit the Bareilly Nagar Nigam official website.

- Navigate to the ‘Online Service Portal’ and select ‘Property Tax’.

- You will be redirected to onlinebnn.com, where you should choose ‘Pay tax’.

- Enter the necessary information and click on ‘Search’ to proceed with your payment options including debit card, credit card, net banking, BHIM, UPI, and e-wallets.

Offline Tax Payment Options

For those who prefer traditional payment methods, property tax can also be paid offline by visiting:

- Address: Nagar Nigam, Bareilly, Opposite Bareilly College, Bareilly Civil Lines, Bareilly (UP), PIN: 243001

- Phone: 0581-6612200

- Mobile: 7055519637

- Email: bareilly@gmail.com

Payments can be made using cash or demand draft directly at the Bareilly Nagar Nigam office.

Post Your Property Free

Download Bareilly Nagar NigamTax Receipt

Securing a receipt for your house tax payment is simple:

- Access the Bareilly Nagar Nigam website.

- Click on the ‘Online Service Portal’ and then select ‘Property Tax’.

- Navigate to onlinebnn.com and choose ‘Receipt’ under ‘View’.

- Input your application number or receipt number to download or print your property tax receipt.

Key Deadlines and Rebates

The deadline for property tax payments in Bareilly is set for December each financial year. Late payments attract penalties, making timely compliance advantageous. Furthermore, Bareilly Nagar Nigam offers several discount incentives for early payments:

- 10% discount for payments made in May, June, and July.

- 7.5% discount for payments during August, September, and October.

- 5% discount for November and December payments.

Changing the Name on Your Property Tax Bill

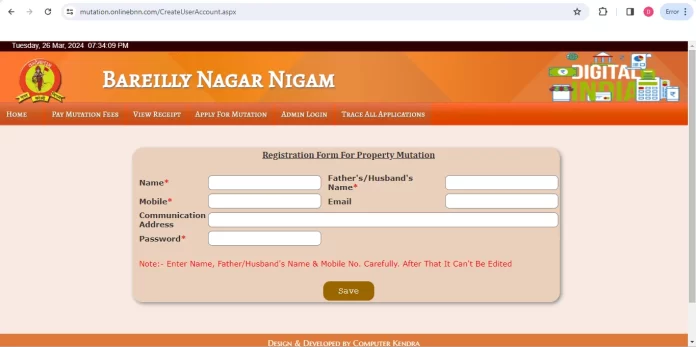

To change the name on your property tax bill, follow these steps:

- Visit the official website and access the ‘Online Service Portal’.

- Select ‘Property Tax’ and then ‘Apply for Mutation’.

- If you’re not registered, select ‘New Registration’ and enter the necessary details.

- Save your registration and log in with your mobile number and password.

- Complete the required fields and pay the mutation fees to finalize the name change.

Conclusion

Understanding and utilizing the Bareilly Nagar Nigam’s property tax system is crucial for all property owners in the area. By following the outlined processes for both online and offline payments, taxpayers can benefit from a streamlined approach that not only saves time but also offers financial incentives for early compliance. Whether you’re calculating your dues, making a payment, or retrieving a tax receipt, Bareilly’s system is designed to support you every step of the way.

Frequently Asked Questions (FAQ’s)

Ans: Bareilly Nagar Nigam Property Tax is an annual fee levied on property owners in the city of Bareilly. This tax is collected by the Bareilly Municipal Corporation and is used to fund various public services like road maintenance, sanitation, and public schooling.

Ans: To obtain a receipt for your property tax payment, visit the Bareilly Nagar Nigam website, go to the ‘Online Service Portal’, select ‘Property Tax’, and then ‘Receipt’ under the ‘View’ section. Enter your application or receipt number to access and print your tax receipt.

Latest Blogs

- Your Mumbai Dream Home Awaits: MHADA Lottery 2024 Registration, apply online

- Chitta Patta apply online Tamilnadu 2024: Complete Guide

- What is the Land Titling Act: How it Helps Farmers