What is an Income Tax Return (ITR)?

An Income Tax Return (ITR) is a form that lets you report your income, expenses, tax deductions, investments, taxes paid, and more to the Indian government. It’s mandatory to file an ITR under certain circumstances, but there are other reasons to file even if your income isn’t high, such as carrying forward losses, claiming a tax refund, or getting a visa.

What is e-filing?

E-filing is the process of submitting your ITR online. You can do this through the new income tax portal using your PAN card as your login. E-filing offers several benefits that make filing your taxes easier.

Documents Required for e-filing ITR

Before you e-file your ITR, you’ll need to have some documents and information handy. These include:

- PAN card and Aadhaar card

- Bank statements

- Form 16 (if you receive a salary)

- Donation receipts (for charitable donations)

- Stock trading statements from your broker

- Receipts for life and health insurance premiums you’ve paid

- Bank account information linked to your PAN card

- Mobile number registered with Aadhaar for e-verification of your return

- Interest certificates from banks

Alternatively, you can e-file your ITR on ClearTax by only providing your PAN. Cleartax can auto-fill most of your details, such as salary income, tax deducted at source (TDS), and deductions, from the Income Tax Department database.

Open Plots Near Hyderabad

Also Read: Mastering ITR Form V Verification & Acknowledgement Download

How to E-file Your ITR on the Income Tax Portal

Here’s a step-by-step guide on how to e-file your ITR on the Income Tax Department’s website:

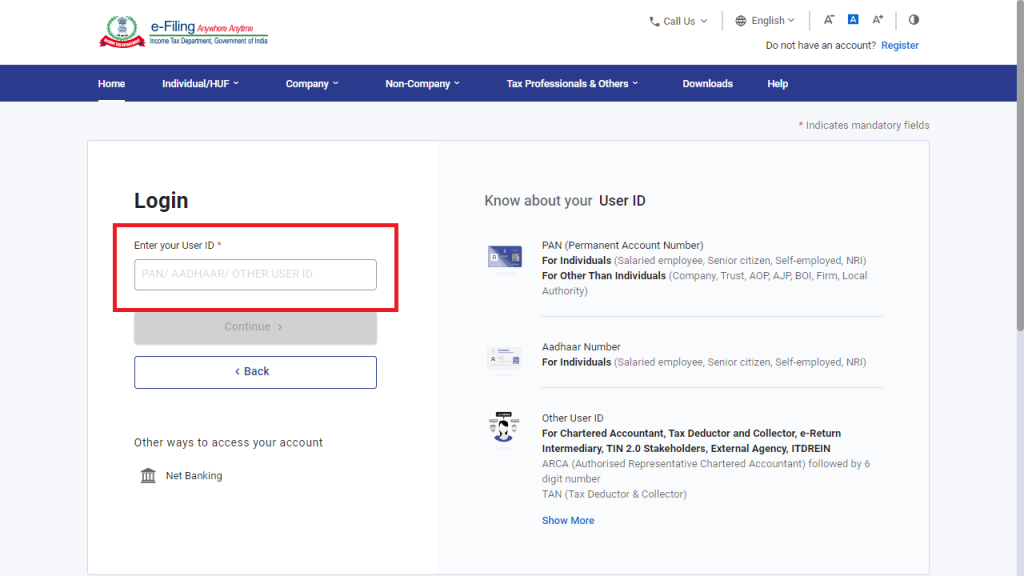

- Login: Go to the official Income Tax e-filing website and log in using your PAN and password.

- Go to ‘File Income Tax Return’: Click on the “e-File” tab, then “Income Tax Returns,” and finally “File Income Tax Return.”

- Select the Assessment Year: Choose the correct assessment year. For example, if you’re filing for the financial year 2023-24, the assessment year will be 2024-25. Also, select “Online” as the filing mode and choose whether this is an original or revised return.

- Select Filing Status: Choose your filing status, such as “Individual,” “HUF” (Hindu Undivided Family), or “Others.”

- Choose the ITR Form.

- Select the appropriate ITR form: There are seven ITR forms available, but only ITR forms 1 to 4 are applicable for individuals and HUFs. You can find out which ITR form you need to file based on your income sources.

- Reason for Filing ITR: Choose the reason why you’re filing your return. Options include having a taxable income exceeding the basic exemption limit, meeting specific criteria that mandate filing an ITR, or other reasons.

- Validate Pre-filled Information: The website will pre-fill some of your information, such as your PAN, Aadhaar, name, date of birth, contact details, and bank details. Carefully review this information for accuracy before proceeding. You’ll also need to provide your bank account information if it’s not already pre-filled.

- Review and Verify: As you go through the process, make sure to disclose all relevant income, exemptions, and deductions. Most of your information will be pre-filled based on data received from your employer, bank, etc. Carefully review this information to ensure it’s correct. Confirm the summary of your return, validate the details, and make any tax payments if necessary.

- e-Verify ITR: The final and most important step is to e-verify your return within 30 days. If you don’t e-verify your return, it’s considered not filed. You can e-verify using various methods, such as Aadhaar OTP, electronic verification code (EVC), net banking, or by mailing a physical copy of ITR-V to the Central Processing Center (CPC) in Bengaluru.

Frequently Asked Questions (FAQ’s)

Ans: An Income Tax Return (ITR) is a form that allows you to report your income earned in a financial year to the Indian government. It includes details about your income sources, expenses, deductions, taxes paid, and investments.

Ans: E-filing is the process of submitting your ITR electronically through the government’s income tax portal. It offers a convenient and faster alternative to traditional paper-based filing.

Latest Blogs

- PM Kisan Status of self-registered farmers, beneficiary list, and name correction 2024

- List of All Himachal Pradesh Government online services in one place

- Veer Savarkar International Airport (Port Blair Airport)