Are You Want to Know More Information on the Housing Loan Process? Then, you must read this blog post. Let’s get into detail about the latest blog post – The 7 Best Housing Loan Process Ways

1) What Is Home Loan?

A home loan is a type of loan that helps people finance the purchase of a house or apartment. A home loan, also known as a mortgage, is a long-term financial commitment that involves borrowing money from a lender, usually, a bank or financial institution, to buy a property.

2) How to Check Home Loan Eligibility?

Checking your home loan eligibility is an important step before applying for a home loan. It helps you determine your borrowing capacity and the loan amount you can avail from a lender. Here are the steps to check your home loan eligibility:

Check your credit score:

Your credit score is one of the most important factors that determine your home loan eligibility. A good credit score can improve your chances of getting a home loan at a lower interest rate. You can check your credit score online through various credit bureaus such as CIBIL, Experian, etc.

Calculate your income:

Your ability to obtain a mortgage depends heavily on your income. You can calculate your income by adding your monthly salary, and any additional income such as rental income, business income, etc.

Calculate your expenses:

Your monthly expenses such as rent, bills, EMIs, etc., also affect your home loan eligibility. You can calculate your expenses by subtracting your monthly expenses from your income.

Use a home loan eligibility calculator:

Most lenders offer a home loan eligibility calculator on their website. You can use the calculator by entering your income, expenses, and other details such as loan tenure, interest rate, etc., to check your eligibility.

Check the lender’s eligibility criteria:

Different lenders have different eligibility criteria. You can check the lender’s website or visit the branch to know the eligibility criteria for their home loan product.

Consider the property value:

The property value also plays a role in determining your home loan eligibility. Lenders usually finance up to 80-90% of the property value, and the remaining amount has to be paid as a down payment. You can check the property value in the local market or through a property dealer.

3) How to Apply for a Home Loan?

Applying for a home loan involves several steps, and it is important to follow the process correctly to increase the chances of getting the loan approved. Here is a step-by-step guide on how to apply for a home loan:

Research and compare lenders:

Before applying for a home loan, research and compare different lenders to find the one that offers the best interest rates, repayment terms, and other features that suit your requirements.

Check your eligibility:

Use a home loan eligibility calculator or visit the lender’s website to check your eligibility for a home loan.

Gather the required documents:

Gather the necessary documents such as income proof, identity proof, address proof, property documents, etc. The required documents may vary depending on the lender’s policy.

Fill out the application form:

Fill out the home loan application form carefully, providing accurate information. You can fill out the application form online or visit the lender’s branch to fill it out in person.

Submit the application and documents:

Submit the completed application form along with the necessary documents to the lender. Make sure that all the documents are in order and complete.

Wait for the loan approval:

The lender will verify your application and documents and may conduct a credit check to assess your creditworthiness. If everything is in order, the lender will approve the loan and send you an offer letter. You may also be asked to provide additional documents or information during the approval process.

Accept the loan offer:

Once you receive the loan offer, read it carefully and accept the offer if it suits your requirements. You may be required to pay a processing fee or administrative charges at this stage.

Sign the loan agreement:

After accepting the loan offer, sign the loan agreement and submit it to the lender along with the necessary documents.

Disbursement of the loan amount:

After the loan agreement is signed, the lender will disburse the loan amount directly to the seller or builder, or in some cases, to your bank account.

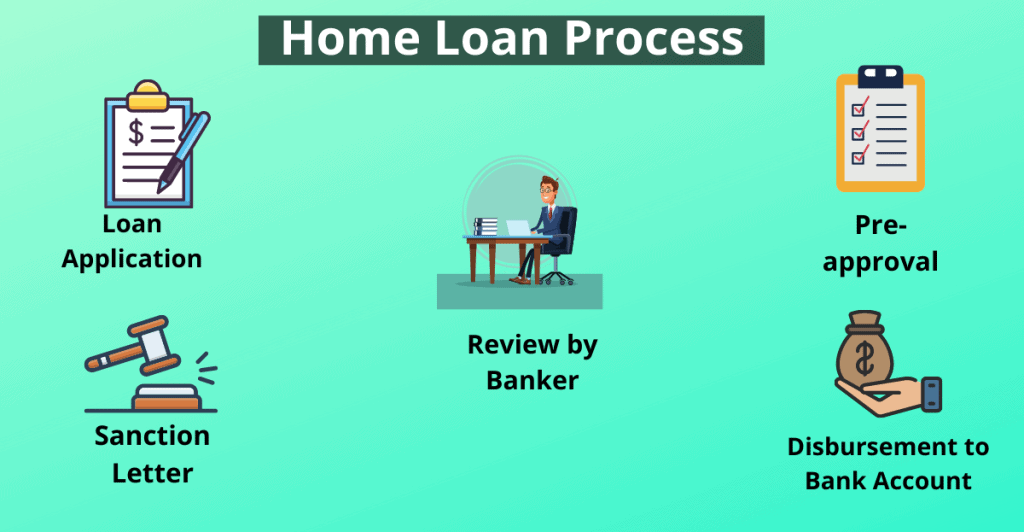

4) House Loan Process

Here are the steps involved in the housing loan process:

Determine Your Budget and Eligibility:

The first step in the home loan process is to determine your budget and eligibility. You can use online tools like a home loan eligibility calculator to determine your eligibility and the maximum loan amount you can get based on your income, age, and credit score.

Choose the Right Lender:

Once you have determined your budget and eligibility, the next step is to choose the right lender. Research different lenders and compare their interest rates, fees, and terms and conditions to find the best deal.

Fill in the Application Form:

Once you have selected the lender, the next step is to fill in the home loan application form. You will need to provide personal information, employment details, and property details in the application form.

Provide the Required Documents:

After filling in the application form, you will need to provide the required documents to the lender. The documents required may vary from lender to lender, but some of the common documents required are discussed below.

Loan Approval and Disbursement:

After submitting the application and required documents, the lender will verify your details and the property details. If everything is in order, the lender will approve the loan and disburse the amount to the seller.

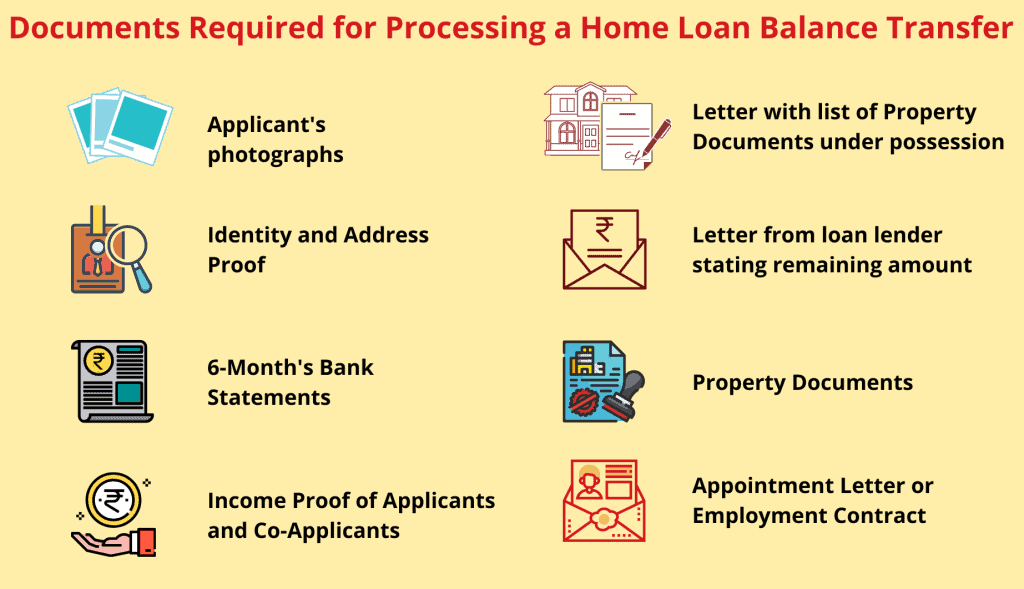

5) What are the Documents Required for Housing Loan

Here are the documents that are generally required when applying for a home loan:

Identity Proof:

You will need to provide government-issued identity proof such as an Aadhaar card, PAN card, passport, or driver’s license.

Address Proof:

You will need to provide address proof such as an Aadhaar card, passport, utility bills, or bank statements.

Income Proof:

You will need to provide income proof such as salary slips, Form 16, bank statements, or income tax returns.

Property Documents:

You will need to provide property documents such as a sale agreement, title deed, and other legal documents.

Bank Statements:

You will need to provide bank statements for the last six months to show your financial stability and repayment capacity.

Employment Proof:

You will need to provide employment proof such as an appointment letter, salary certificate, or employment contract.

Photographs:

You will need to provide passport-size photographs for the application form.

6) Housing Loan Sanction Process

Application submission:

The first step is to submit the housing loan application form along with the required documents to the lender. The time taken for this step depends on the borrower’s readiness to submit the documents and the lender’s requirement for document verification.

Verification of documents:

Once the lender receives the application and documents, they will verify the documents to assess the borrower’s eligibility for the loan. This process can take anywhere from a few days to a few weeks, depending on the lender’s process and the volume of applications received.

Property assessment:

After verifying the borrower’s documents, the lender will assess the property’s value and location. This step is crucial to determine the loan amount and the borrower’s repayment capacity. The property assessment can take a few days to a few weeks, depending on the property’s location and accessibility.

Loan sanction:

If the lender finds the borrower eligible and the property assessment is satisfactory, they will sanction the loan amount. The loan sanction letter will detail the loan amount, tenure, interest rate, and other terms and conditions.

7) How to Repay a Housing Loan

Here are the steps to repay your housing loan:

Determine your EMI:

The principal balance and interest paid on the loan are both included in the EMI. The EMI includes both the principal amount and the interest charged on the loan. You can use an online EMI calculator to determine your EMI based on the loan amount, tenure, and interest rate.

Set up auto-debit:

Most banks and lenders offer the option of setting up an auto-debit facility, which deducts the EMI amount directly from your bank account on the due date. This ensures timely payment of EMIs and reduces the chances of missing any payments.

Make prepayments:

You can make prepayments towards your housing loan to reduce the outstanding principal amount and save on interest charges. Most lenders allow prepayments without any penalty charges, subject to certain conditions.

Refinance your loan:

If you find that the interest rate on your housing loan is higher than the prevailing market rates, you can consider refinancing your loan with another lender. Refinancing can help you save on interest charges and reduce your overall loan burden.

Monitor your credit score:

Timely repayment of your housing loan can have a positive impact on your credit score. It is important to monitor your credit score regularly and take steps to improve it, such as paying your EMIs on time, reducing your credit card usage, etc.

Conclusion

The housing loan process can be daunting, but with proper research and preparation, it can be a smooth and hassle-free process. Make sure to determine your budget and eligibility, choose the right lender, fill in the application form, and provide the required documents to increase your chances of loan approval. Contact us now for our experts.

Also, Read Our Latest Blog Posts:

- Do You Know 13 Myths About HMDA Master Plan?

- Why Must Visit 15 Places in Hyderabad?

- Do You Know-BEST 10 PLACES TO VISIT IN WARANGAL

- Gold vs Real Estate: Which Is The Better & Smart Investment?

- Which House Facing Direction is Better to Live?

- 8 Helpful Advantages& Disadvantages – Investing in Hyderabad RealEstate

- GST: 2023 – A Game Changer for India’s Economy

Frequently Asked Questions

A: A housing loan is a type of loan offered by banks and other financial institutions to help individuals purchase or construct a house or apartment.

A: You can check your home loan eligibility by using an online eligibility calculator, which takes into account your income, age, credit score, and other factors.

A: Typically, you will need to provide income proof, identity proof, address proof, property documents, and other supporting documents as per the lender’s requirements.

A: A credit score is a numerical representation of your creditworthiness based on your credit history. A higher credit score indicates that you are more likely to repay your loans on time, and lenders are more likely to approve your loan application and offer favorable terms.

A: Equated Monthly Instalment is EMI. EMI is a set amount that a borrower must pay a lender on a specific date each month for a set period of time.