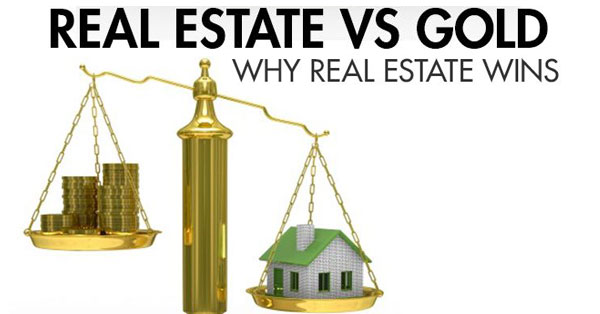

Are You confused about which is the better investment- Gold vs Real Estate? Then, you must read this blog post. Let’s get into detail about the latest blog post – Gold vs Real Estate: Which Is The Better Investment? for more info.

Gold and real estate are two popular investment options that have been used by people for centuries. While both investments can provide a store of value and potential appreciation, they have distinct characteristics that may appeal to different investors.

Gold is a precious metal that has been valued for its rarity and beauty for thousands of years. It is considered a safe haven investment during times of economic uncertainty or inflation. The value of gold is typically negatively correlated with the stock market, meaning that when stock prices fall, gold prices may rise.

Real estate, on the other hand, is a tangible asset that can provide both rental income and capital appreciation. It is typically viewed as a long-term investment and can be used as a hedge against inflation. Real estate is also considered a diversification strategy, as it can provide a different source of return compared to traditional stocks and bonds.

which investment is better: gold or real estate?

The answer depends on several factors, including an investor’s risk tolerance, investment objectives, and time horizon.

For those seeking a safe haven investment, gold may be a better option. It is a highly liquid asset that can be easily traded, and its value tends to rise during times of economic uncertainty. Gold is also a relatively simple investment to understand, as there are few variables that can impact its price.

On the other hand, real estate may be a better choice for investors seeking both rental income and capital appreciation. Real estate requires more expertise and due diligence than gold, as factors such as location, property condition, and tenant quality can significantly impact its value. However, real estate can also provide a consistent stream of income over time, making it a popular choice for long-term investors.

Ultimately, the choice between gold and real estate will depend on an investor’s personal preferences and investment goals. Both investments have their pros and cons, and it is important to carefully consider each option before making a decision. As with any investment, it is also important to diversify across different asset classes to minimize risk and maximize potential returns.

Which Option Do You Select-Buying Gold or Purchasing a Plot?

When it comes to deciding between buying gold and purchasing a plot of land, there are a few key factors to consider. One is your investment time horizon. If you’re looking for a short-term investment that can be easily bought and sold, gold may be a better option. However, if you’re looking for a long-term investment that can provide both income and capital appreciation, real estate may be a better choice.

Another factor to consider is your investment goals. If you’re looking for a safe haven investment that can protect your wealth during times of economic uncertainty, gold may be a better choice. However, if you’re looking for an investment that can provide a consistent source of income and long-term growth potential, real estate may be a better option.

Lastly, your risk tolerance is an important consideration. Investing in gold is generally considered less risky than investing in real estate, as gold is a more stable asset class. However, real estate can provide a higher return on investment and maybe a better choice for investors with a higher risk tolerance.

Why investing in real estate better than buying gold?

Investing is a crucial part of building wealth and securing financial stability for the future. While there are many investment options available, two of the most popular ones are real estate vs gold. Both have their pros and cons, but when it comes to choosing between the two, real estate comes out as a better investment choice.

Tangible Asset:

Real estate is a tangible asset that provides an intrinsic value, unlike gold, which is a non-productive asset that provides no intrinsic value. When you invest in real estate, you own a physical property that you can use or rent out to generate income. On the other hand, gold is a commodity that doesn’t generate any income and only holds value as long as people are willing to pay for it.

Income-Generating:

Real estate is an income-generating investment. When you buy a property, you can rent it out and earn a steady stream of income. In contrast, gold doesn’t generate any income, and its value depends on market fluctuations. Moreover, the income from real estate can be used to pay off mortgage payments, maintenance expenses, and taxes, which is not possible with gold.

Inflation Hedge:

Real estate is an excellent hedge against inflation. As the cost of living increases, so does the rent you can charge for your property, which means your income grows in value over time. On the other hand, gold is not an effective hedge against inflation since it doesn’t generate income or cash flow.

Appreciation:

Real estate has the potential for appreciation, which means that its value can increase over time. This appreciation can come from various sources such as increased demand, improvements in the property, or location. While gold has a long history of holding value, it doesn’t have the same potential for appreciation as real estate.

Tax Benefits:

Investing in real estate provides several tax benefits that are not available with gold. For example, you can deduct mortgage interest, property taxes, and other expenses from your income taxes. Additionally, when you sell a property that has appreciated in value, you can defer capital gains taxes through a 1031 exchange.

Leverage:

Real estate is one of the few investments that allow for leverage. You can borrow money to purchase a property and use the income generated to pay off the loan. This allows you to purchase more properties and increase your income and net worth. In contrast, you cannot leverage gold since it is a non-productive asset.

Conclusion:

In conclusion, gold vs real estate can be good investments, depending on your investment goals, time horizon, and risk tolerance. While gold may be a better choice for short-term investments or during times of market volatility, real estate can provide a steady source of income and long-term growth potential. Ultimately, it’s important to carefully consider your investment options and consult with a financial advisor before making any investment decisions. Call our real-estate experts now

Also, Read Our Latest Blog Posts:

- The New Evolution of Telangana Secretariat and The Tallest Ambedkar Statue: Symbol of Equality and Justice

- A Wonderful Drive Trip On Outer Ring Road, Hyderabad

- Brief Info of Regional Ring Road, Hyderabad

- Hyderabad Metro Route Maps, Timings, Ticket Rates

- Vande Bharat Express: India’s High-Speed Marvel

- Exploring Hyderabad’s Mobility Valley: The Hub of Innovation and Connectivity

- Do You Know 13 Myths About HMDA Master Plan?

- Why Must Visit 15 Places in Hyderabad?

- Do You Know-BEST 10 PLACES TO VISIT IN WARANGAL

Frequently Asked Questions

A: Gold is generally considered a safer investment than real estate as it is a more stable asset class that can provide a hedge against inflation and market volatility.

A: Real estate has the potential to offer higher returns than gold over the long term as it can provide both capital appreciation and rental income.

A: Gold is generally considered a better short-term investment as it is more liquid and can be easily bought and sold, whereas real estate requires a longer time horizon for investment returns.